Actionable advice, tax strategies, and bookkeeping insights for business owners who want to feel informed—not overwhelmed.

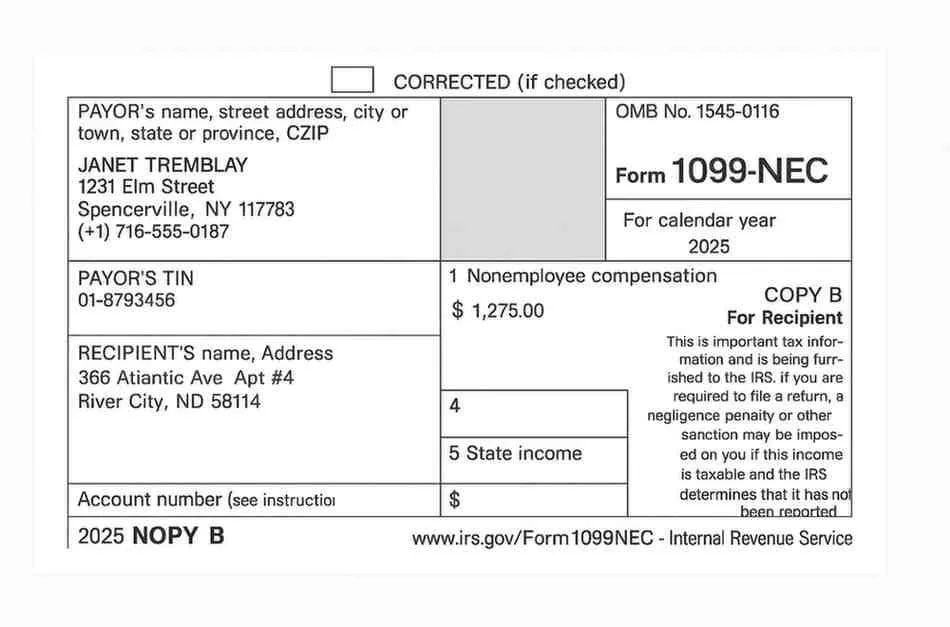

Your Essential Year-End Guide to 1099 and W-2 Preparation for Small Businesses

Get your business ready for year-end tax reporting with this essential guide to 1099 and W-2 preparation. Learn the rules for contractor payments, IRS deadlines, penalties, W-9 requirements, e-filing mandates, and year-end payroll compliance.

No Tax on Overtime in 2025? Here’s What You Really Need to Know

You may have seen the headlines (or TikToks): “Overtime pay isn’t taxed anymore!” While the new 2025 tax law does include a deduction for overtime, it’s not as cut-and-dried as social media is making it sound.

I’m breaking it down for you below — what’s true, what’s not, and what we’re still waiting on from the IRS.

Ready to Stop Guessing and Start Growing?

If my blog helped bring a little clarity to your financial chaos, imagine what we can do together? Let’s dig into your books, uncover hidden savings, and get you back to loving your business again!