No Tax on Overtime in 2025? Here’s What You Really Need to Know

The Truth About the New Overtime Deduction

You may have seen the headlines (or TikToks): “Overtime pay isn’t taxed anymore!” While the new 2025 tax law does include a deduction for overtime, it’s not as cut-and-dried as social media is making it sound.

I’m breaking it down for you below — what’s true, what’s not, and what we’re still waiting on from the IRS.

✅ What Is the Overtime Deduction?

Starting with the 2025 tax year, eligible hourly workers can deduct the overtime premium portion of their wages from their federal taxable income.

What counts?

Only the amount above your regular pay — usually the 0.5x “bonus” you earn for working overtime.

For example, if you earn $50/hour normally and get time-and-a-half ($75/hour) for OT, only the $25/hour extra qualifies for the deduction. Your regular pay is still fully taxed.

👷 Who Qualifies for This Deduction?

This deduction only applies to non-exempt workers, as defined by the Fair Labor Standards Act (FLSA) §13(a)(1).

If you’re salaried, a manager, or a professional (like doctors, lawyers, CPAs, etc.), you’re probably considered exempt — even if your boss pays you overtime voluntarily. And here I was going to switch my pay to hourly, shucks!

Want to double-check your status? Here’s a link to the DOL’s guide on exemptions.

🧾 Do You Still Pay Other Taxes on Overtime?

Yes. Even with the deduction:

You still owe Social Security (FICA)

You still owe Medicare

You still owe state and local income taxes (if applicable)

This only removes a portion of federal income tax liability from your overtime premium.

💰 Will Withholding Go Down on Paychecks?

No — at least not yet. The IRS has until the end of 2025 to issue guidance for payroll systems for the 2026 tax year. For now:

You’ll pay federal taxes as usual through your paycheck

You’ll claim the deduction on your 2025 tax return, reducing what you owe (or increasing your refund)

📊 How Much Could You Save?

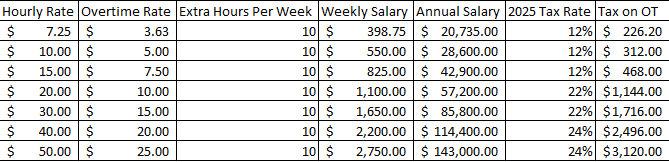

Here’s a simplified estimate of possible federal income tax savings for single W-2 workers with no dependents, working 10 hours of OT per week:

based on 10 hours of OT per week at the 2025 tax rates which remain unchanged from the TCJA

🗓 Is It Retroactive?

Yes — the bill was signed on July 4, 2025, but it applies to all of 2025.

If your overtime records are messy or nonstandard, don’t panic — the IRS is expected to allow approximated calculations once they release formal guidance.

👀 What About Overpaid OT or Tip Income?

If your employer pays more than time-and-a-half, there’s still debate in the tax world about whether the extra amount is deductible. If this were me, I wouldn’t count my chickens before they hatch on any amount paid more than 1.5 times normal rate until the IRS issues guidance.

Also, per §224, any tips earned during overtime hours are excluded from this deduction.

If you’re a tipped worker — sorry, no bonus break here.

🧾 Is There a Cap or Income Limit?

Yes — and it’s important.

Deduction caps:

$12,500 for single filers

$25,000 for married filing jointly

Married filing separately? You don’t qualify (unless you also qualify as Head of Household)

Phaseout thresholds:

Begins at $150,000 for single filers

Begins at $300,000 for MFJ

For every $1,000 over the limit, the deduction is reduced by $100. Partial amounts don’t count (i.e., $150,999 is treated like $150,000).

⏳ What About Comp Time, Union Agreements, or Banked Hours?

If you’re storing overtime as time off instead of getting paid more, the deduction does not apply — because you're not actually earning extra taxable income. Of course, the IRS could get creative here and change this with their guidance, so stay tuned.

Union and employer-specific arrangements? Still waiting on details from the IRS. (We’ll update when we know more.)

📄 It Must Be on Your W-2 to Qualify

As of now, this deduction can only be claimed if reported properly on your 2025 W-2. That means:

Your employer will need to use updated forms (coming soon)

Delays may happen — not because your boss is slow, but because the IRS is understaffed and juggling a lot right now

Tip: Keep your final 2025 pay stub and give it to your tax preparer when you file — it’ll help if forms are delayed. However, no tax pro should file your return without the actual tax form; it just helps breakdown the numbers on the form itself.

Final Thoughts

The “no tax on overtime” law is not a blank check. It’s a limited federal income tax deduction that goes away after December 31, 2028, subject to a lot of rules and reporting requirements — and there are still unanswered questions.

But for many hourly workers, it could mean a few hundred to a few thousand dollars in tax savings next year.

I’ll keep you updated as the IRS releases more information. And if you want to make the most of this (or plan for it), reach out — tax planning is what I do best.

Tags: