Actionable advice, tax strategies, and bookkeeping insights for business owners who want to feel informed—not overwhelmed.

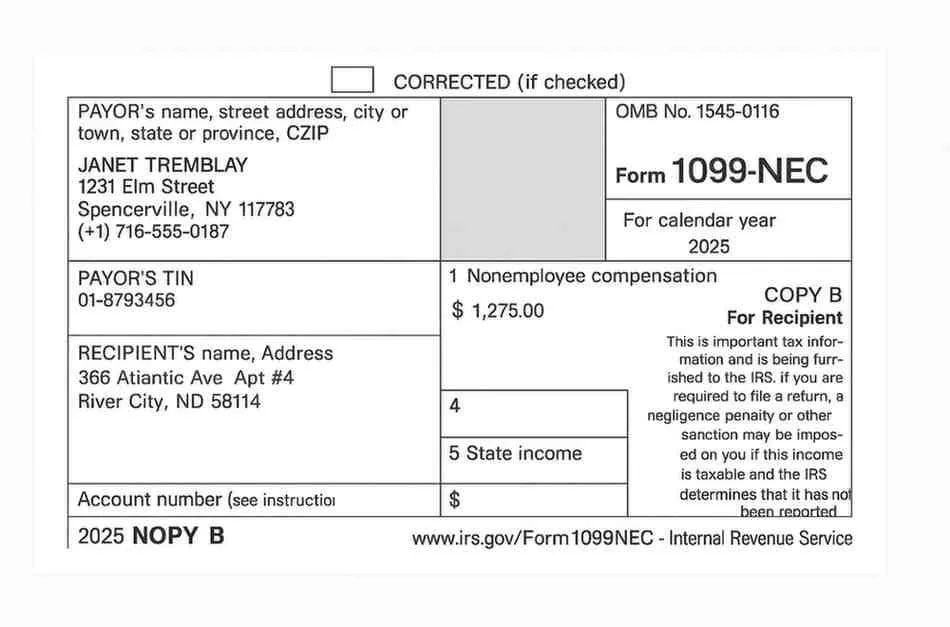

Your Essential Year-End Guide to 1099 and W-2 Preparation for Small Businesses

Get your business ready for year-end tax reporting with this essential guide to 1099 and W-2 preparation. Learn the rules for contractor payments, IRS deadlines, penalties, W-9 requirements, e-filing mandates, and year-end payroll compliance.

Why You Shouldn’t Get Tax Advice from Social Media

Instagram might be great for recipes and dog videos, not so much for tax planning. The IRS has already nailed 32,000 taxpayers who fell for bad advice. Don’t be next.

Health Insurance Costs Are Changing in 2026: Here’s What You Need to Know About the Premium Tax Credit

Remember how health insurance was supposed to get cheaper? Yeah… about that. Starting in 2026, if you get too much Premium Tax Credit, you’ll have to pay it ALL back. No caps, no forgiveness. Fun times ahead.

No Tax on Overtime in 2025? Here’s What You Really Need to Know

You may have seen the headlines (or TikToks): “Overtime pay isn’t taxed anymore!” While the new 2025 tax law does include a deduction for overtime, it’s not as cut-and-dried as social media is making it sound.

I’m breaking it down for you below — what’s true, what’s not, and what we’re still waiting on from the IRS.

Navigating OB3: What Business Owners Must Know About Tax Changes

OB3 (a.k.a. One Big Beautiful Bill) just passed, and while some of it’s good news, there’s also a pile of fine print. And guess what? I’m spending the next few weeks swimming in it — taking continuing ed classes, decoding legalese, and making sure my clients (you) get what they need to stay compliant and save money.

5 IRS Audit Red Flags Business Owners Should Know

Think you're safe from an IRS audit? These 5 common red flags could put you on the radar — especially if you’re a small business owner. Here’s what to know.

10 Pro Tips Every Business Owner Should Know

Being a business owner means wearing 15 hats and putting out fires daily. After years of helping entrepreneurs clean up messes, stay compliant, and grow stronger, I’ve noticed the same key advice comes up again and again. Here are the 10 most important tips I give to business owners — the ones that protect your business, your sanity, and your future.

Unlock Savings for Your Business with the Work Opportunity Tax Credit (WOTC)

Running a business means juggling priorities, but one thing you don’t want to overlook is the opportunity to save on taxes while making a meaningful impact. The Work Opportunity Tax Credit (WOTC) is a federal incentive designed to encourage employers to hire individuals from specific target groups facing barriers to employment. Here’s how it works and why your business should take advantage of it.

Why Extension Isn’t a Dirty Word

Ah, tax season—a time filled with numbers, deadlines, and just a hint of chaos. But let’s talk about something that gets a bad rap: tax extensions. No, they’re not a sign of failure or disorganization, nor is extension a dirty word. In fact, they’re often a smart move for business owners and individuals alike.

Key Person Insurance: Protect Your Business & Avoid Tax Pitfalls

First off, I owe you an apology for missing blog last week—it’s tax season, and things have been a little hectic around here! But I’m back, and today we’re diving into a topic that’s crucial for business owners: Key Person Insurance.

Choosing an Accountant Who Puts Your Goals First

There is an endless supply of do-it-yourself tax preparation tools and websites, and the sheer volume of options can lead you to believe the process of filing your returns is simple. However, a DIY approach only works if you are satisfied with paying more than necessary. Tax preparation software handles all of the basics, importing income and considering common tax deductions. Unfortunately, when it comes to careful application of less-common tax-reduction techniques, these programs simply can’t compete with a skilled tax professional.

Understanding Vehicle Depreciation and Taxes

When it comes to running a business, vehicle expenses often become a significant topic of discussion. Understanding vehicle depreciation and taxes can help you make informed decisions and maximize your deductions. Here’s everything you need to know about Section 179 and how it applies to different types of vehicles.

Why You Should Implement an Accountable Plan in Your Business

As a business owner, maximizing tax benefits while keeping your finances organized is crucial. One of the most effective ways to do this is by implementing an Accountable Plan. This IRS-approved system helps you reimburse employees for business expenses without creating additional tax liabilities. In this blog post, we’ll explain what an Accountable Plan is, how it works, and why it’s a smart choice for your business..

Save Thousands by Avoiding This Payroll Mistake

Employees vs independent contractors is a common issue that can lead to serious financial and legal consequences. Some workers know they are classified as contractors but don’t realize they’re misclassified, meanwhile others have no idea at all.

Choosing the Right Business Entity: LLC, S-Corp, Sole Prop (and Yes, C-Corp Too)

Starting a business? It’s time to talk about business entity types—the legal structure that determines how you’re taxed, how much personal risk you’re exposed to, and whether the IRS gives you side-eye during tax season.

Why Mixing Business and Personal Expenses is Bad for Business

Running a business is tough enough without making costly mistakes that can destroy your legal protections and lead to tax trouble. One of the most common — and dangerous — mistakes small business owners make is mixing business and personal expenses.

Small Business Strategies for Rising Tariffs

This matters for anyone who relies on products that cross borders at some point in their journey. Even if you’re not the direct importer, your suppliers likely are—and those added costs will trickle down to you.

Tax Scams You Need to Watch Out For: The IRS Dirty Dozen 2025

Ah, tax season—the most wonderful time of the year (said no one ever). But just when you thought filing your taxes was stressful enough, the IRS has once again graced us with its annual Dirty Dozen list—a lineup of the most common and dangerous tax scams in 2025. Because what’s tax season without a little extra paranoia?

Is Tracking Mileage Worth It for Your Business? Here’s What You Need to Know

If your business involves a lot of driving—whether you’re a cleaner, landscaper, contractor, or any other type of service provider—you’re probably using a fleet of vehicles daily. With the rising costs of running a business, you might be wondering: Is tracking mileage worth the effort? The answer is not always straightforward, but by the end of this post, you’ll have a clear understanding of how tracking mileage can benefit your business financially, especially when it comes to tax time.

Why an IP PIN Should Be Part of Your Cybersecurity Plan

Tax-related identity theft is a growing concern, and securing an Identity Protection Personal Identification Number (IP PIN) should be a top priority this tax season. The IRS flagged over 1 million potentially fraudulent tax returns by March 2023 for the 2022 tax season (Source).

Ready to Stop Guessing and Start Growing?

If my blog helped bring a little clarity to your financial chaos, imagine what we can do together? Let’s dig into your books, uncover hidden savings, and get you back to loving your business again!